Population Growth & Urban Momentum

Dubai has reached 4 million residents in August 2025, doubling from just 2 million in 2008. This pace is unmatched compared to most developed cities.

Annual Growth: Over 169,000 new residents added in 2024, one of the fastest increases since 2018.

Workforce Magnet: A strong job market in finance, logistics, technology, and tourism drives population inflows.

Global Appeal: Expats form nearly 90% of the population, ensuring continued demand for housing and rentals.

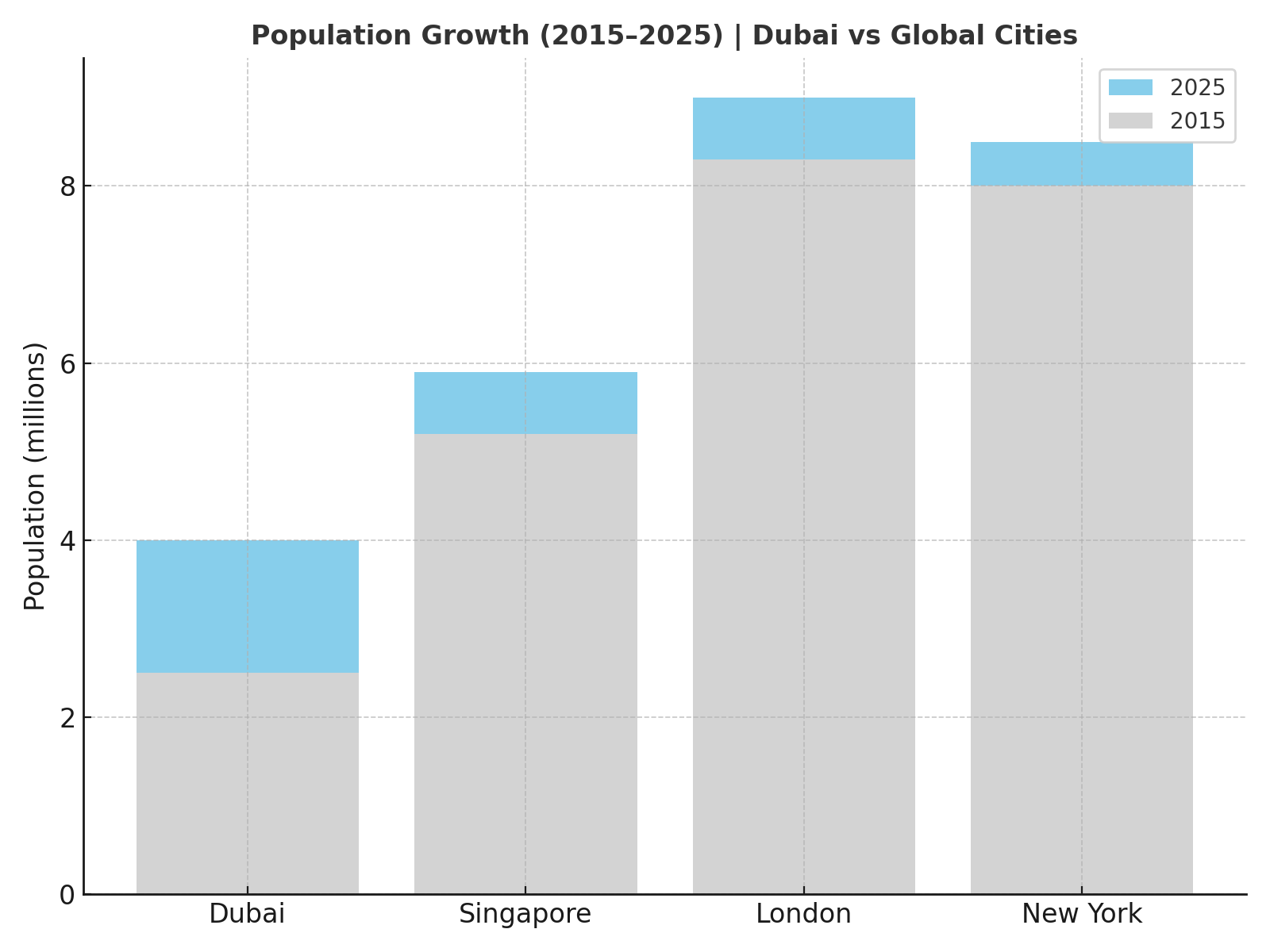

📊 Population Growth Comparison (2015–2025)

| City | 2015 Pop. | 2025 Pop. | % Growth | Notes |

|---|---|---|---|---|

| Dubai | 2.5M | 4.0M | +60% | Fastest among global hubs |

| Singapore | 5.2M | 5.9M | +14% | High density, land constraints |

| London | 8.3M | 9.0M | +8% | Slower approvals, affordability issues |

| New York | 8.0M | 8.5M | +6% | Mature but limited yield growth |

Housing Demand: Luxury to Affordable

Dubai’s real estate market is directly shaped by rising population demand.

Luxury Segment: Villas in Palm Jumeirah, Emirates Hills, and Al Barari saw 100% value increases in 4 years.

Mid-Market: Areas like Jumeirah Village Circle and Dubai South offer affordable apartments with strong ROI.

Affordable Housing Policies: More than 17,000 new affordable units are under construction under Dubai’s Urban Master Plan 2040.

📊 Projected Housing Demand (2025)

| Property Type | Expected Demand (Units) | Target Market |

|---|---|---|

| Luxury Villas | 10,000+ | High-net-worth investors |

| Premium Apartments | 18,000+ | Professionals & expat families |

| Affordable Housing | 23,000+ | Middle-income & long-term renters |

Price Trends: Record-Setting and Sustainable?

Apartments: Average AED 1,750 per sqft (up 75% since 2021).

Villas: Some gated communities doubled in price since 2021.

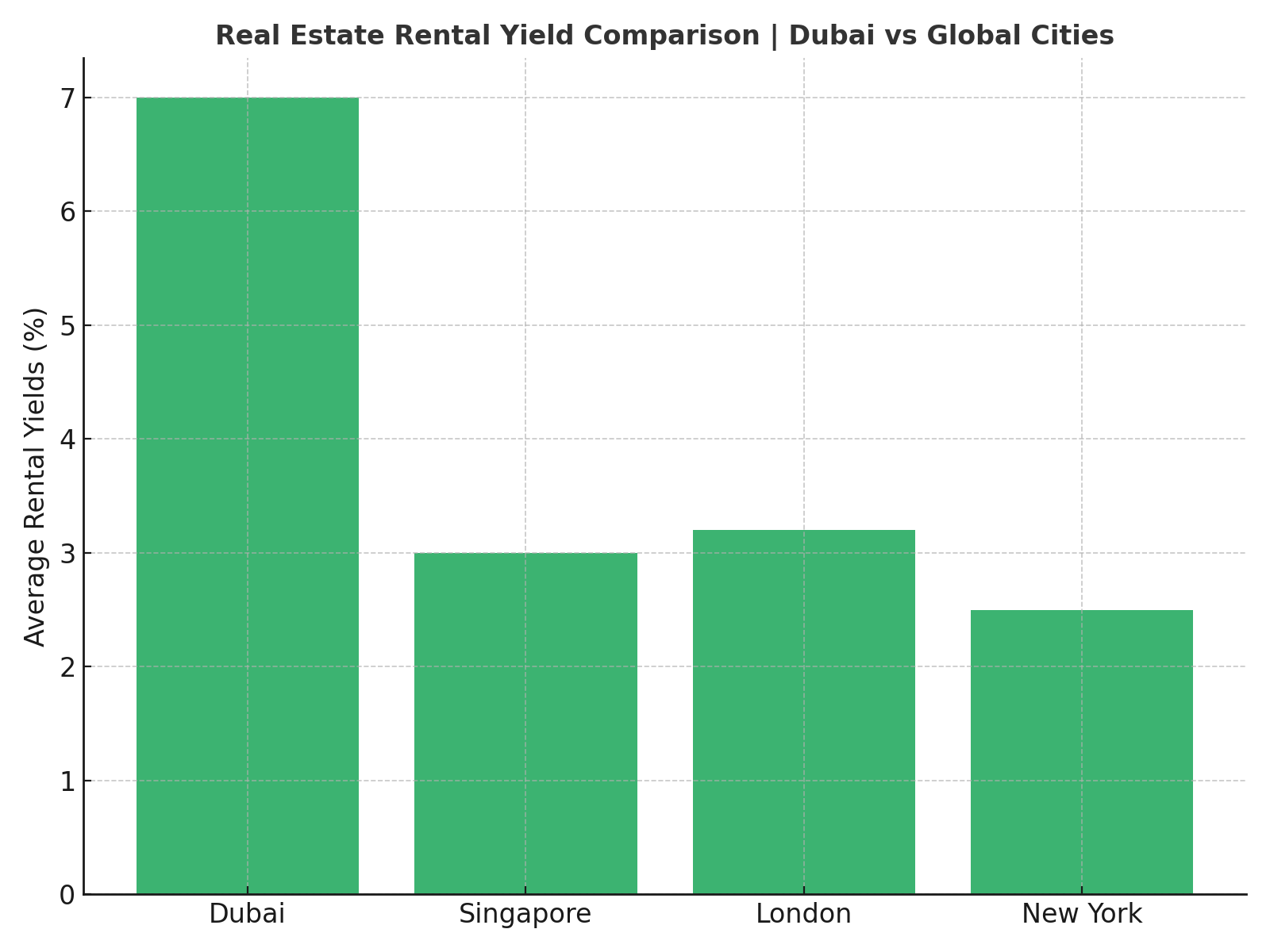

Global Comparison:

| City | Avg. Price (per sqft) | 10-Year Trend | Rental Yield |

|---|---|---|---|

| Dubai | AED 1,750 | +75% (2021–25) | 6–8% |

| London | AED 4,000+ | +12% | 2–3% |

| New York | AED 5,500+ | +8% | 2.5% |

| Singapore | AED 3,800 | +10% | 3% |

🔑 Investor Insight: Dubai property is cheaper per sqft but delivers higher rental yields than global peers.

Infrastructure & Master Planning

The Dubai Urban Master Plan 2040 anticipates 7.8 million residents by 2040, with policies ensuring balanced urban growth:

60% Green Spaces: Parks, waterfronts, and eco-friendly areas.

Transport: Metro extensions, autonomous taxis, and better highways.

New Hubs: Focused development in Dubai South, Dubai Creek Harbour, and Business Bay.

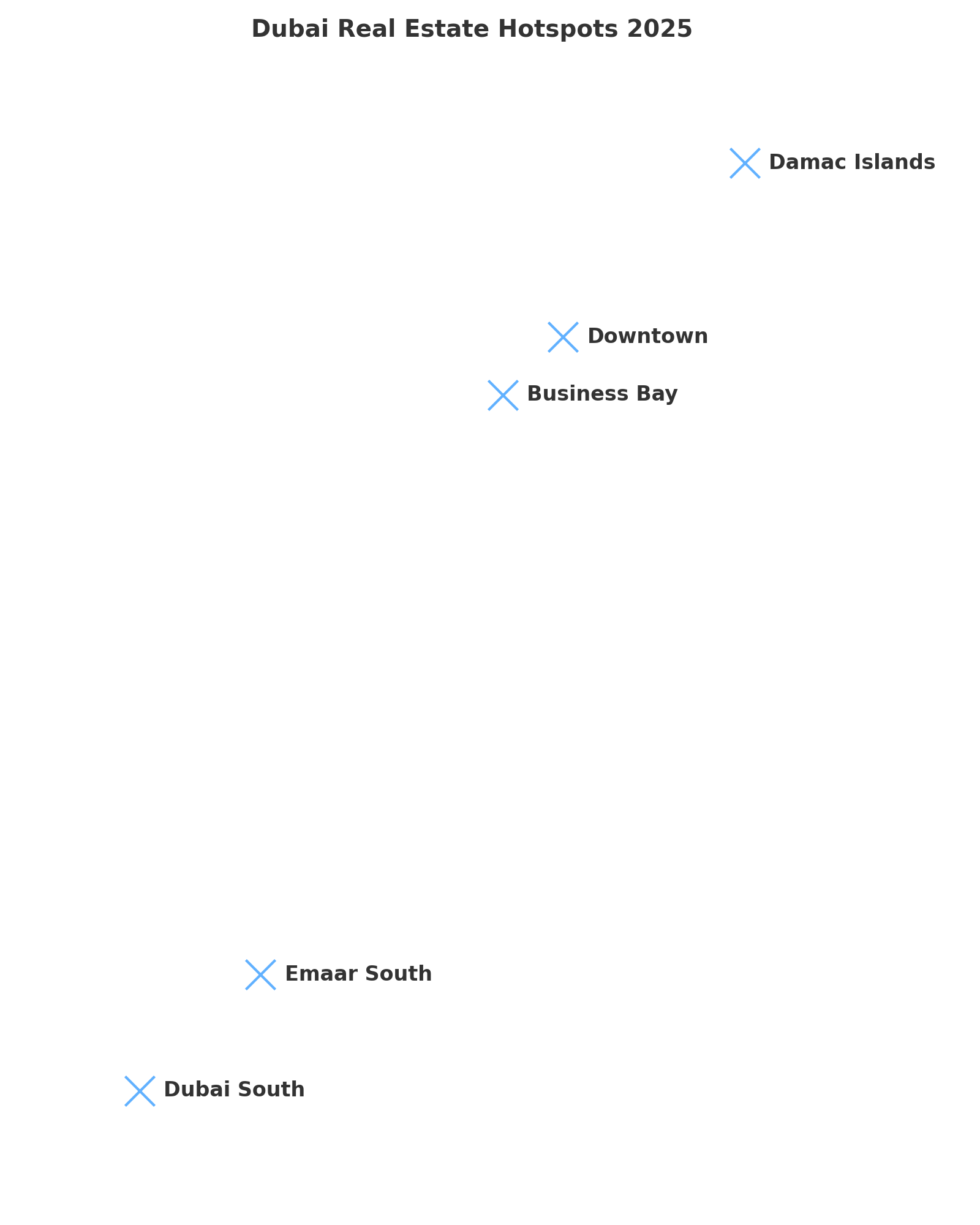

Emerging Investment Hotspots

📍 Dubai South – Affordable luxury near Al Maktoum Airport, strong growth potential.

📍 Emaar South – Family-oriented community with golf course living.

📍 Business Bay & Downtown – Premium apartments, high rental demand, Burj Khalifa lifestyle.

📍 Damac Islands – Limited supply, waterfront exclusivity, luxury-focused.

📊 Investment Hotspot Snapshot

| Area | Property Focus | Avg. Yield | Key Investor Appeal |

|---|---|---|---|

| Dubai South | Mid-market, affordable | 7–8% | Airport + Expo growth |

| Emaar South | Villas & townhouses | 6–7% | Family living, golf lifestyle |

| Business Bay | Premium apartments | 6–8% | Downtown proximity, high rentals |

| Damac Islands | Waterfront luxury | 7%+ | Scarcity & exclusivity |

Why Investors Should Act Now

Population boom: 4 million residents = immediate housing demand.

ROI edge: Dubai’s rental yields beat most world-class cities.

Tax benefits: No property tax, no capital gains tax.

Global city growth: Dubai is becoming a rival to London, New York, and Singapore in real estate prominence.

The Investor’s Takeaway

Dubai’s new 4 million population milestone is not just symbolic it’s a real estate catalyst. With rising housing demand, higher yields than other global hubs, and ambitious master planning, the city is positioned for sustained growth through 2030 and beyond.

This is why most savvy investors are entering now locking in off-plan projects, premium apartments, and affordable housing before prices climb further.

📲 Need Expert Guidance?

This is exactly how we’ve helped many of our clients by matching them with the right communities, the right units, and the right investment timing.

✅ Book a Free Consultation today:

WhatsApp: +971 585 259 680

Email: 💌 info@dubairealestateprincess.com

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)