Downtown Dubai has always been the heartbeat of the city an urban masterpiece combining luxury living, iconic landmarks, and global investment appeal. With property demand surging in 2025, the question on many investors’ minds is:

👉 Is now the right time to invest in Downtown Dubai or should you consider other areas?

Let’s dive into the details, compare with other prime communities, and uncover where the best opportunities lie.

1. Why Downtown Dubai Stands Out

Key Highlights

• Unmatched Location: Directly connected to Sheikh Zayed Road, DIFC, and Business Bay.

• Lifestyle Destination: Burj Khalifa, The Dubai Mall, Dubai Opera, and five-star hotels at your doorstep.

• Global Demand: Attracts investors from Europe, China, India, the US, and GCC nations.

• Rental Powerhouse: High occupancy rates driven by both corporate professionals and tourists.

Unlike newer communities, Downtown is

already fully established.

That means less construction risk and more consistent rental returns.

2. Market Snapshot: Downtown Dubai (2025)

Factor | Current Status (2025) | What It Means for Investors |

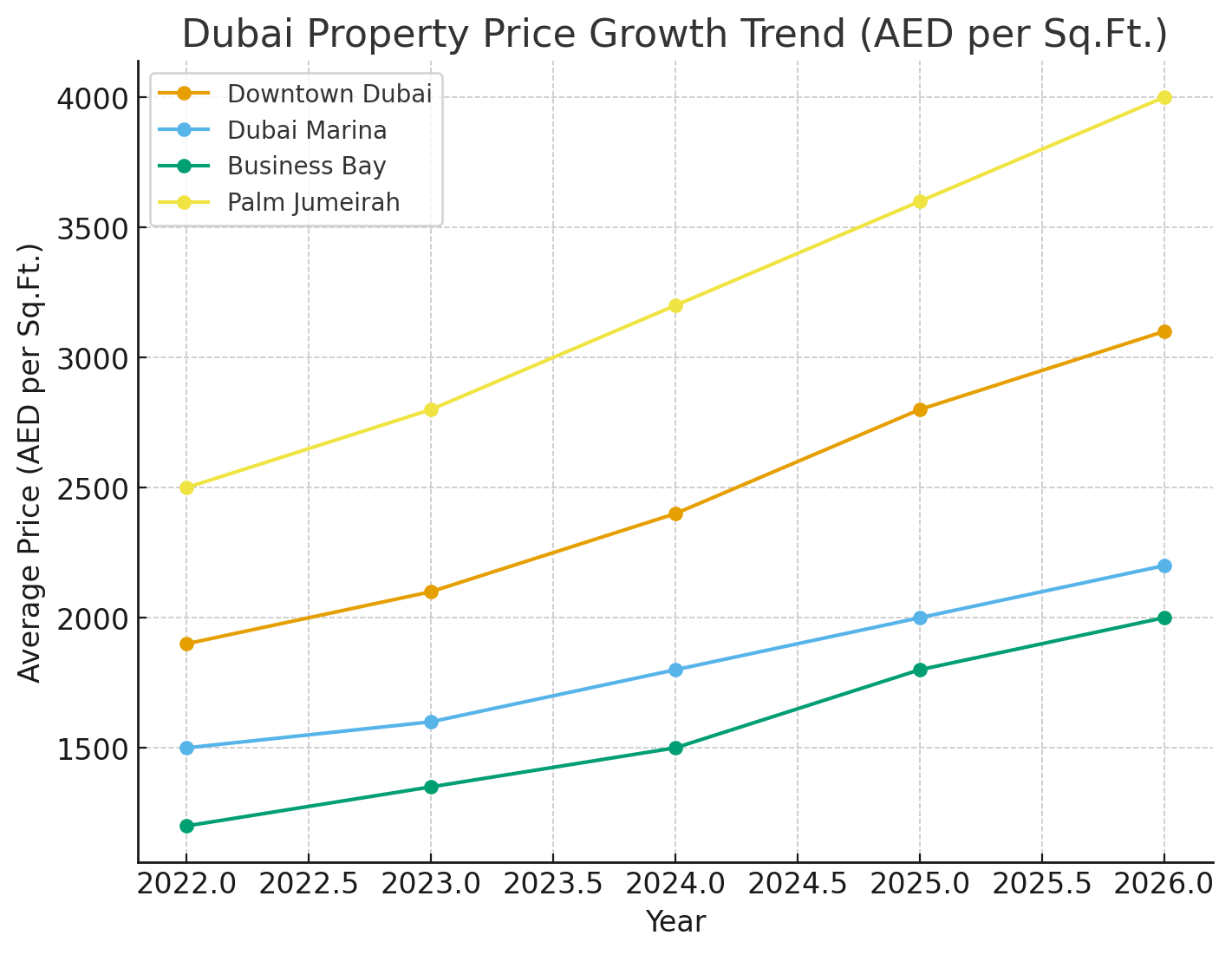

Average Price per Sq. Ft. | AED 2,300 – AED 3,200 | Premium pricing, proven appreciation |

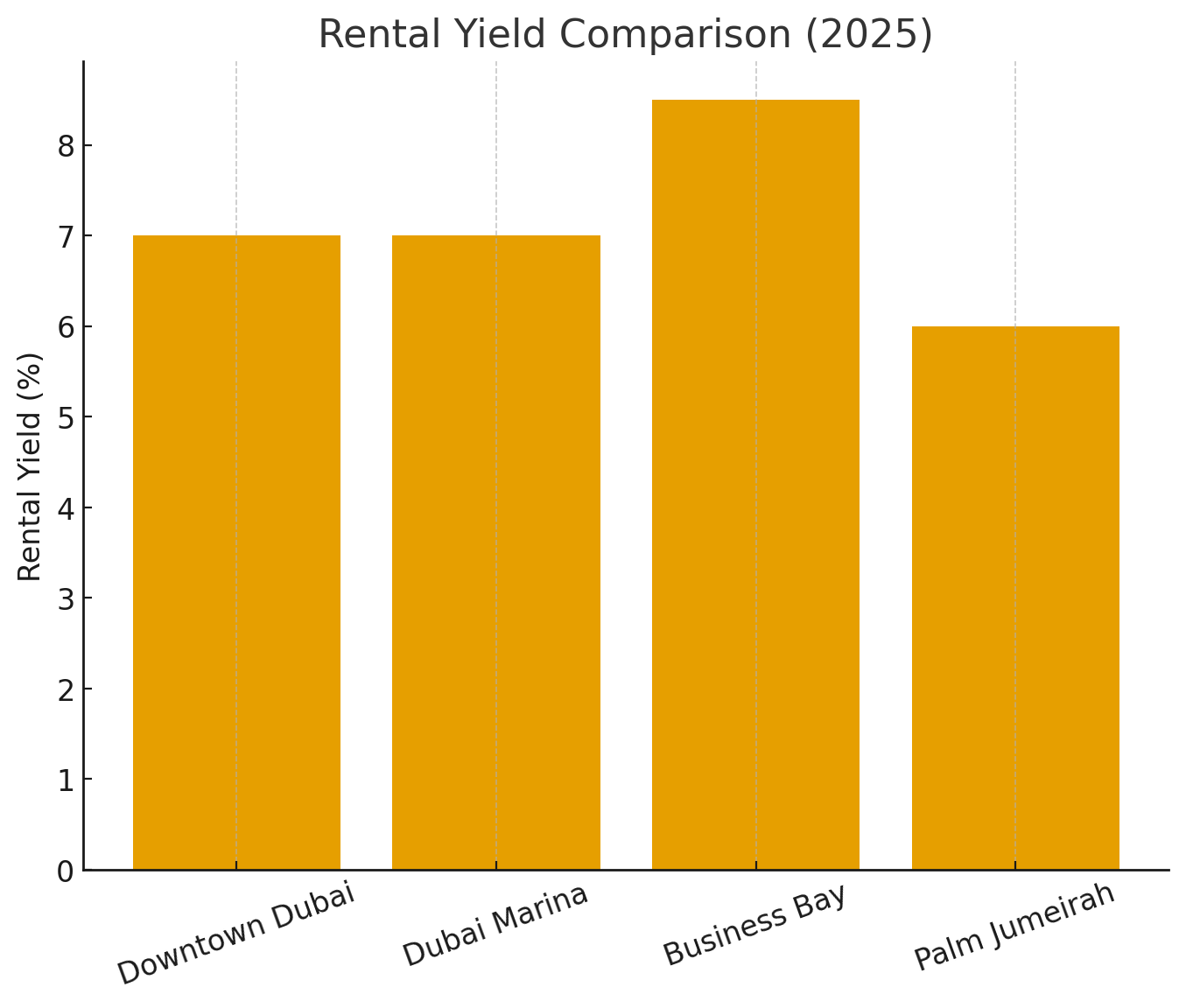

Rental Yields | 6% – 8% (short-term rentals can exceed 10%) | Strong ROI vs. global luxury cities |

Capital Appreciation | 15% – 20% YOY growth post-Expo & ongoing demand | Excellent for long-term investors |

Buyer Profile | 70% International investors | High liquidity & global appeal |

Upcoming Developments | New cultural districts, upgraded public spaces, retail | Sustains growth, boosts property values |

3. How Downtown Compares with Other Dubai Hotspots

Many investors ask whether they should put their money in Downtown or in other high-demand communities. Let’s look at a clear comparison:

Community | Avg. Price per Sq. Ft. | Rental Yield | Buyer Profile | Key Strengths | Potential Weaknesses |

Downtown Dubai | AED 2,300 – 3,200 | 6% –8% | Global HNIs, corporates | Iconic location, global prestige | Higher entry cost |

Business Bay | AED 1,500 – 2,100 | 7% – 9% | Young professionals | Cheaper entry, strong rental demand | Less luxury appeal than Downtown |

Dubai Marina | AED 1,700 – 2,400 | 6% – 8% | Expats & tourists | Waterfront living, lifestyle hotspot | Saturated rental competition |

Palm Jumeirah | AED 2,800 – 4,200 | 5% – 7% | UHNW investors, end-users | Ultra-luxury, global brand recognition | High maintenance, niche market |

Key Takeaways from the Comparison

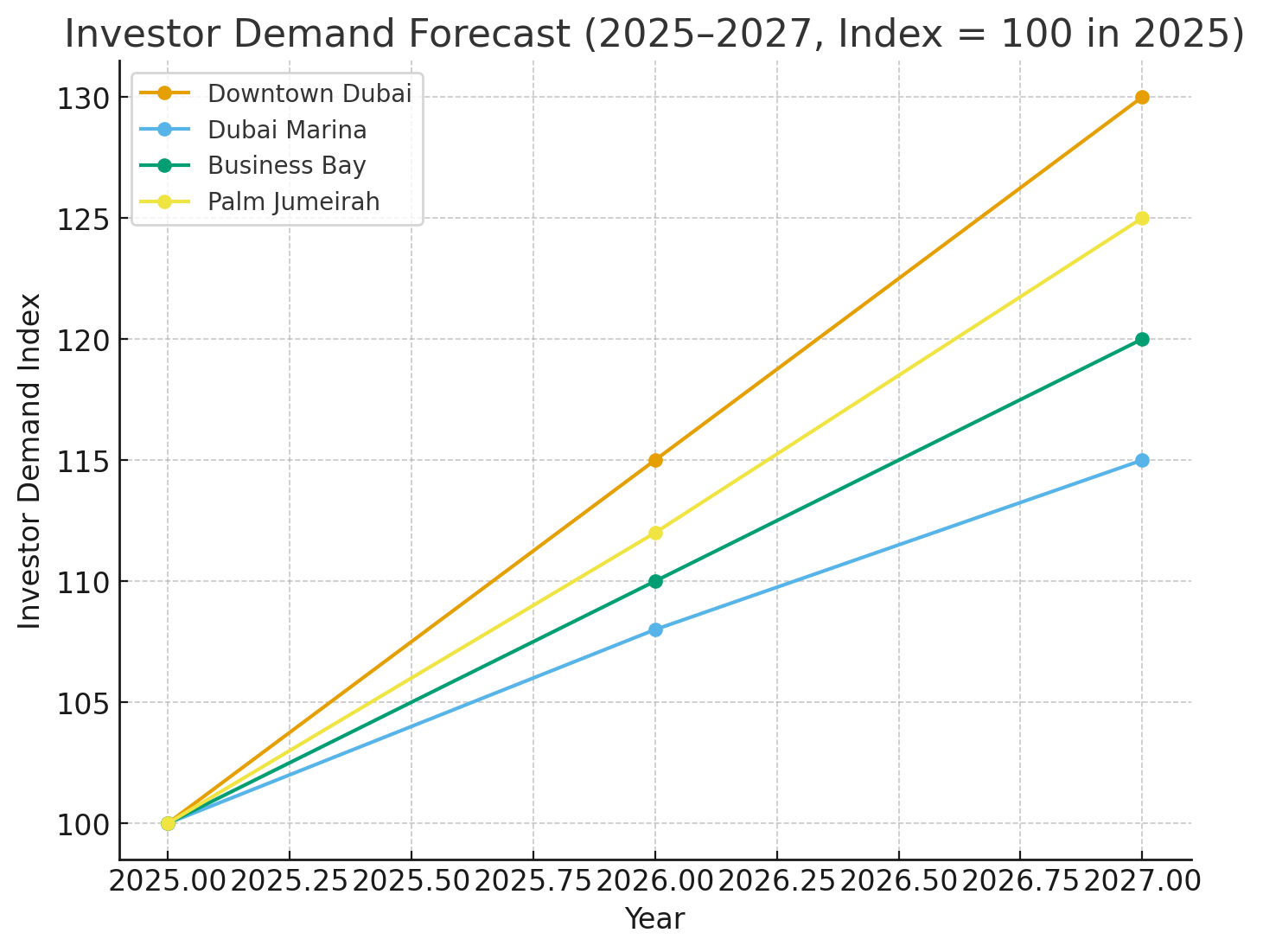

• Best for Prestige & Liquidity → Downtown Dubai

• Best Entry-Level Option with High Yield → Business Bay

• Best for Lifestyle & Tourism Rentals → Dubai Marina

• Best for Ultra-Luxury & Exclusivity → Palm Jumeirah

5. Who Should Invest in Downtown Dubai?

Downtown makes the most sense for:

✅ Investors seeking global prestige & high liquidity.

✅ Those targeting short-term rental income (Airbnb yields among the city’s best).

✅ Buyers focused on long-term capital appreciation in Dubai’s most iconic district.

✅ High-net-worth individuals diversifying portfolios into trophy assets.

If you are more yield-focused on a smaller budget, Business Bay may be better. If lifestyle appeal matters most, Dubai Marina shines. But for safety, prestige, and strong long-term ROI—Downtown remains unmatched.

6. How We’ve Helped Our Clients

Most of our clients came to us unsure about where to invest. With proper guidance:

• A UK client secured a 1BR Downtown apartment in 2023 for AED 2.1M—today it’s valued at AED 2.7M.

• A client from India invested in short-term rentals in Downtown and is now enjoying 8.5% annual ROI.

• Several GCC investors bought early in Opera District projects and have already seen double-digit appreciation.

What worked for them was having expert advice, tailored ROI forecasts, and access to off-market deals before the wider public.

1. Dubai Property Price Growth Trend (AED per Sq.Ft.) showing Downtown, Marina, Business Bay, and Palm Jumeirah growth from 2022–2026.

2. Rental Yield Comparison (2025) – This bar chart highlighting yield differences between top areas.

3. Investor Demand Forecast (2025–2027) – demand growth index across key communities.

7. Ready to Explore?

If you’re considering investing in Downtown Dubai, now is the time to act before the next price surge.

📲 Book a free consultation today:

• WhatsApp: +971 58 525 9680

• Email: info@dubairealestateprincess.com

This is exactly how we’ve helped most of our clients secure profitable investments in Dubai by giving them clarity, confidence, and access to opportunities others miss.

Bottom line: Downtown Dubai isn’t just a real estate purchase it’s a global trophy asset. While Business Bay and Dubai Marina offer excellent yield options, Downtown remains the strongest mix of prestige, capital growth, and liquidity in 2025.

Related posts:

Regional tension has raised questions among residents and investors. Here’s a structured, calm assessment of Dubai’s stability and the practical safety measures every UAE resident should follow.

AI-powered relocation services are changing how global buyers, founders, and families land in Dubai, not just by “finding a home,” but by reducing uncertainty across visas, schooling, lifestyle mapping, and long-term property strategy. Used correctly, AI becomes a private decision...

Categories

- 🏡 Nad Al Sheba Living

- Business Bay / Downtown Dubai

- ⛳ Jumeirah Golf Estates Living

- 💧 District One Living

- 🌳 Dubai Hills Living

- 🌊 Palm Jumeirah Living

- Testimonials & Success Stories

- Community Events & Sustainability

- Eco-Luxury Lifestyle Blog

- Luxury Rental Market

- Dubai’s Green Communities

- Property Management & Sustainability

- Relocation to Dubai

- Off-Plan Developments

- Investment Opportunities

- 🌿 Al Barari Living

- Buyer Resources

- Dubai Real Estate Princess

- Off-Market Exclusives

- Eco-Luxury Properties

- Sustainable Investing

- Luxury Living in Dubai

- Sellers’ Guide

- Dubai Market Insights

- House architecture

- News

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)