Dubai’s real estate market has entered a golden era. In 2025, foreign investors, global entrepreneurs, and HNWIs are flocking to the city for its unmatched tax benefits, Golden Visa opportunities, and high rental yields. But the ultimate question remains:

Should you invest in off-plan projects or ready properties for the best returns?

Both strategies can deliver strong ROI — but in very different ways. Let’s break it down.

What Are Off-Plan Properties?

Off-plan properties are homes purchased before completion, often directly from developers like Emaar, Nakheel, or Sobha. Investors buy at launch or early stages, sometimes years before handover.

Advantages:

• Lower entry prices (often 10–20% cheaper than ready).

• Attractive payment plans with installments.

• Potential for high appreciation by handover.

• Access to exclusive new projects before public resale.

Risks:

• Delayed construction.

• Market fluctuations during the build period.

• No immediate rental income.

What Are Ready Properties?

Ready properties are completed homes available for immediate handover and rental income.

Advantages:

• Instant rental yields (cash flow from day one).

• Safer investment (property already built).

• Easier resale in the secondary market.

Risks:

• Higher upfront costs.

• Less appreciation potential compared to off-plan launches.

• Limited choice compared to exciting new projects.

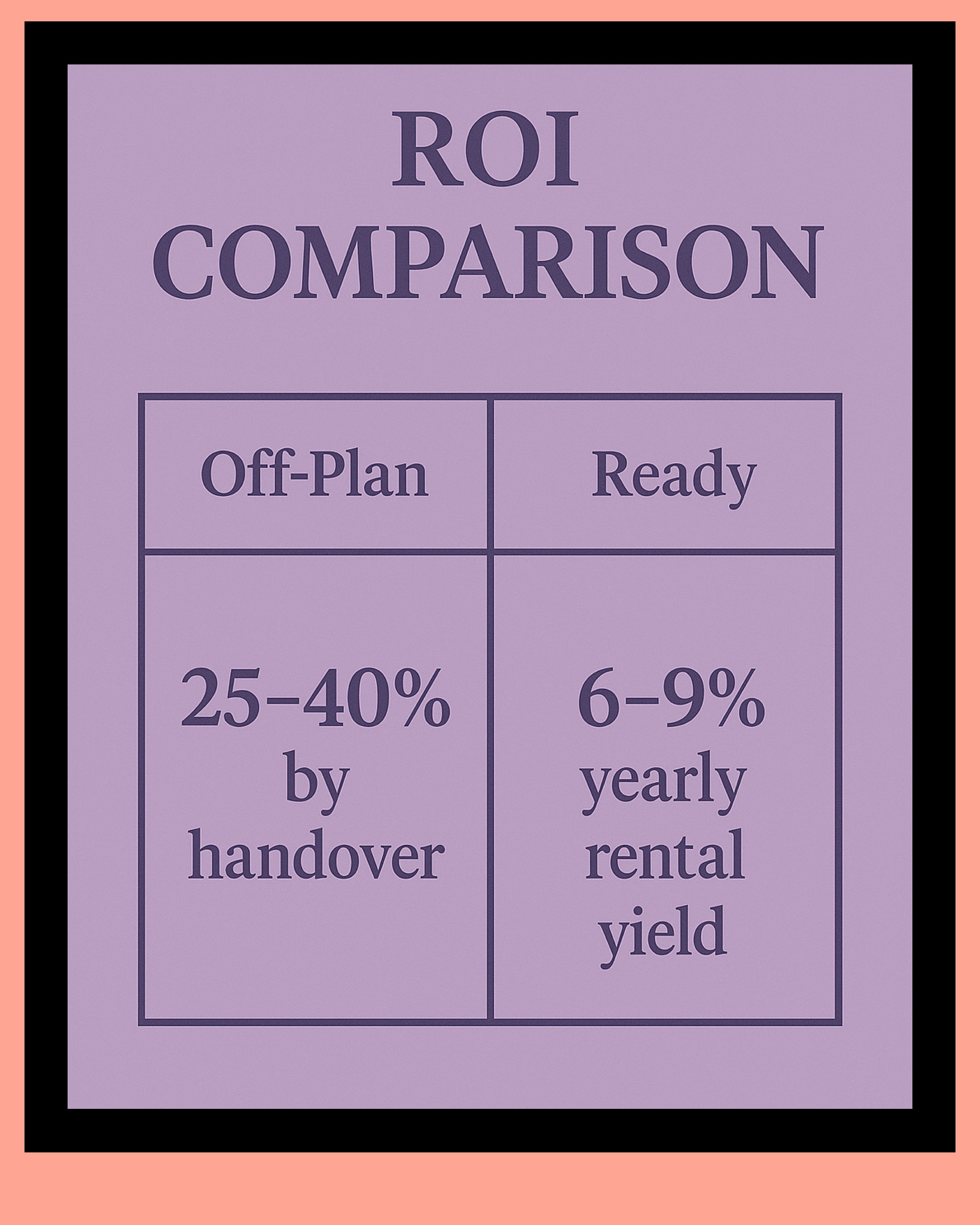

ROI Comparison in Dubai 2025

Here’s a clear breakdown of how both perform:

Factor | Off-Plan Properties | Ready Properties |

Initial Price | 10–20% lower than market rate | Market price or higher |

Payment Plan | Flexible, often post-handover | Full upfront or mortgage |

Rental Income | Starts after completion | Immediate |

ROI Potential | 25–40% by handover in prime areas | 6–9% yearly rental yield (steady cash flow) |

Liquidity | Medium (resale depends on project stage) | High (ready demand in Dubai is strong) |

Risk Level | Higher (construction, delays, market shifts) | Lower (finished, ready-to-rent asset) |

Which Is Better in 2025?

• For short-term gains: Off-plan is king. Early investors in launches like Palm Jebel Ali and District One West have already seen double-digit appreciation.

• For stable income: Ready properties deliver consistent rental yields — especially in communities like Dubai Marina, Downtown, and JVC.

• Balanced portfolios: Many investors combine both — off-plan for appreciation and ready for rental income.

Real Investor Scenarios

• A client bought into Al Barari Ixora Villas off-plan for AED 4M in 2022. By 2025, resale value reached AED 7.9M.

• Another investor purchased a ready apartment in JVC for AED 850K. Within weeks, they secured a tenant at AED 70K yearly rent — an 8% yield.

Both strategies work — but align with your goals.

Final Thoughts

The Dubai market in 2025 is unique: off-plan properties offer explosive growth, while ready homes provide safety and steady income. The right choice depends on your financial strategy, risk appetite, and time horizon.

At Dubai Real Estate Princess, we’ve helped most of our clients maximize returns through free consultations tailoring solutions that match their budgets and goals.

📲 Book your free consultation today:

WhatsApp: +971585259680

Email: info@dubairealestateprincess.com

Related posts:

Regional tension has raised questions among residents and investors. Here’s a structured, calm assessment of Dubai’s stability and the practical safety measures every UAE resident should follow.

AI-powered relocation services are changing how global buyers, founders, and families land in Dubai, not just by “finding a home,” but by reducing uncertainty across visas, schooling, lifestyle mapping, and long-term property strategy. Used correctly, AI becomes a private decision...

Categories

- 🏡 Nad Al Sheba Living

- Business Bay / Downtown Dubai

- ⛳ Jumeirah Golf Estates Living

- 💧 District One Living

- 🌳 Dubai Hills Living

- 🌊 Palm Jumeirah Living

- Testimonials & Success Stories

- Community Events & Sustainability

- Eco-Luxury Lifestyle Blog

- Luxury Rental Market

- Dubai’s Green Communities

- Property Management & Sustainability

- Relocation to Dubai

- Off-Plan Developments

- Investment Opportunities

- 🌿 Al Barari Living

- Buyer Resources

- Dubai Real Estate Princess

- Off-Market Exclusives

- Eco-Luxury Properties

- Sustainable Investing

- Luxury Living in Dubai

- Sellers’ Guide

- Dubai Market Insights

- House architecture

- News

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

UAE Tension and Dubai Stability: Safety Measures & Smart Investor Positioning

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

AI-Powered Relocation Services in Dubai Dubai relocation concierge, HNW relocation Dubai, Dubai property strategy, relocation risk checklist, private

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

Why It’s Profitable to Buy a Branded Dubai Residence or Penthouse in 2026

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

How Dubai Becoming the First Government to Accept Bitcoin & Crypto for Tax and Fee Payments Changes the Game for Real Estate Investors

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)

🌿 The Cape at Al Barari: The Final Chapter of Dubai’s Most Iconic Nature Community (Full Investor Guide)